- You are here:

- Home »

- Blog »

- Use Real Estate for Financial Independance »

- Sell Some Assets and Private Lend the Money for Financial Independence (Retirement)

Sell Some Assets and Private Lend the Money for Financial Independence (Retirement)

Some investors who have gained financial independence continue to keep some properties in order to hedge against inflation and continue to provide growth of their asset base over time. Private lending provides income, and usually that income is being used by the real estate investor for part or most of their monthly income.

Depending on what the investor needs or wants there are different percentages of what they will maintain as part of their real estate portfolio and what they will use for private lending.

One investor that I talked to have 20% of their income coming from private lending, but they want to increase that to 50%.

I asked DurhamREI member Michael Dominguez what the biggest benefits he found with private lending after growing a portfolio of rentals. I will share the quote here as his comment makes sense when you consider his “Phases of Real Estate Investing.”

“I heard recently the term Entrepreneur’s Trap. Many self made people don’t know how and when to shut it down and focus on things other than work.

I truly enjoyed helping others reach their financial goals, but I had dreams outside of real estate as well.

I am literally answering this question from Disneyworld park in Orlando Florida, outside of Star Tours, with the Star Wars soundtrack playing in the background.

Real estate and wealth building helped get me to this point.

However, one reaches a time where wealth building is far less significant than cash flow. Simply put, private lending offers you better cash flow / immediate return on your investment than holding real estate in the Durham Region.

My goal became a few years ago, to earn enough cash flow to fund my very ambitious lifestyle.

One last comment. There is a massive life difference if your net worth grows 10X from $5K to $50K. I feel it is more huge lifestyle jumps from 50K to $500K and again to $5M.

But the time it would take to 10X again really didn’t seem worth the potential return to bring me to $50M.

I chose lifestyle over net worth.”

There are risks associated with private lending just like there are to real estate investing. Some investors do private lending directly to other investors or through Mortgage Brokers, others seem to use Mortgage Funds and MICs that seem to spread the risk but lowers the returns. These Mortgage Funds or MICS are usually focused on either first mortgages, second mortgages, develop financeing or a combination which changes the risk and returns.

This is an example of keeping 50% of the properties and continuing to benefit from the growth of the real estate assets over time.

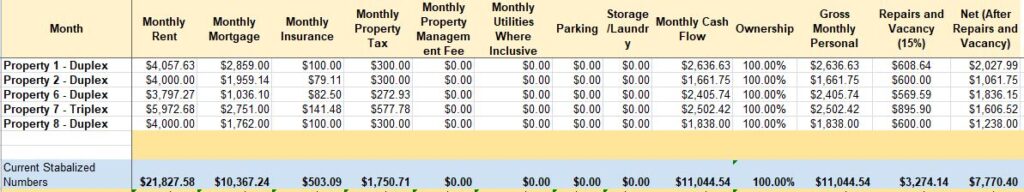

In addition, to the income from the real estate portfolio you decide to lend the funds between 8-10%, let’s use an average of 9%, and the after capital gains tax amount of 2.1 million that we discussed in “Sell Some Assets and Pay Off the Rest for Financial Independence (Retirement).” This would create an additional interest income of $15,750 per month, added to the 7,770 of cash flow, which would be 23,520 per month.

If you could get a 10% average using private lending that number would be $17,500 per month, added to the 7,770 of cash flow, which would be 25,270 per month.

These are the eleven ways that I have seen real estate entrepreneurs use their properties to retire:

Using Real Estate for Financial Independence (Retirement) <–start here

Cash Flow from your Property Portfolio for Financial Independence (Retirement)

Sell Some Assets and Pay Off the Rest for Financial Independence (Retirement)

Sell Some Assets and Private Lend the Money for Financial Independence (Retirement) <– you are here

VTB Mortgages on Apartment Buildings then Private Mortgages for Financial Independence (Retirement)

Sell All Assets and Invest in Lower Return Investments for Financial Independence (Retirement)

Have a Trophy Asset/s and Sell Off Other Assets for Financial Independence (Retirement)

Refinance Assets Annually from your Property Portfolio for Financial Independence (Retirement)

Invest in Other People’s Deals for Growth for Financial Independence (Retirement)

De-accumulation of Assets Over Time for Financial Independence (Retirement)

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Risk and Reward As A Real Estate Investor

Using Real Estate for Financial Independence (Retirement)

Convert Real Estate Portfolio Into a REIT or Fund for Inter-generational Wealth and for Financial Independence (Retirement)

VTB Mortgages on Apartment Buildings then Private Mortgages for Financial Independence (Retirement)

Sell Some Assets and Pay Off the Rest for Financial Independence (Retirement)