- You are here:

- Home »

- Blog »

- Use Real Estate for Financial Independance »

- Sell Some Assets and Pay Off the Rest for Financial Independence (Retirement)

Sell Some Assets and Pay Off the Rest for Financial Independence (Retirement)

I have heard this strategy a number of times mostly at meetings through the Real Estate Investment Network back in 2008 and 2009. The various speakers talked about “Selling the

Dogs and Keeping the Stars” which was a strategy where you would sell off the properties that were the biggest pain in the butt and use the equity from the sale to pay off the mortgages on the properties that were easiest to manage and best cash flow.

I have not met any Real Estate Investors who have used the strategy but I wanted to make sure to bring it to your attention. If you’re somebody that has used this strategies please leave a comment, I love to hear your reasoning.

My guess is that the paying off of the mortgage gives the investor the security of not having to have a mortgage on those properties and increase their cash flow that would have gone towards the mortgage.

In the 1 to 4 unit space I see a couple of problems with this.

The first problem I see with this strategy is the type of returns you are giving up by paying down a mortgage. If the current mortgage rate is 5% and you can get a yield on your cash of more than 5% it doesn’t make a lot of sense to pay off the mortgage.

The other challenge is that when you are not getting income from a job or business it is unlikely that you are going to get financing again from financial institutions. You probably are going to want to keep the mortgages that you have because it’s unlikely that you’re going to be able to get them again.

In the Commercial Space I see the same issues.

If the cap rate on the property is 4%, any additional money that is used to pay down the mortgage on the property would be yielding effectively 4%. Most people would be able to find better yields in other types of assets.

One of the powerful things about real estate is the ability to Leverage and in multifamily refinancing is one of those ways to sometimes create income. (Although cmhc doesn’t seem to understand that if you are using your rental properties as part of your retirement plan and maintaining those properties, refinancing should be a part of that.)

Let’s use the 10 property residential portfolio (1-4 units) as an example where we are going to sell half of them off that will allow to pay off the mortgage of the others, and also pay the capital gains tax.

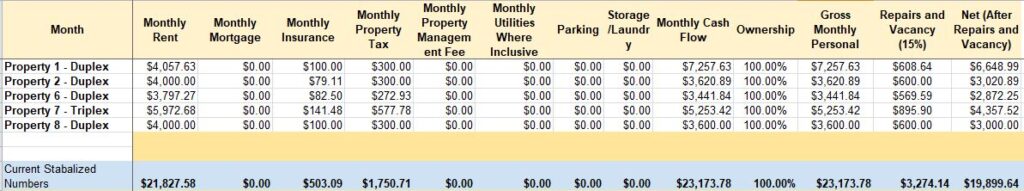

Using the same examples from Cash Flow from your Property Portfolio for Financial Independence (Retirement) the cash flow jumps to almost 20,000 per month, by selling half of the properties and keeping the other half. Remember this is an Ontario example, which is a rent controlled market, so even if expenses go up you may not be able to get your rents up to compensate for this over time.

On the surface, this seems like a good use of the capital in that you created close to $9000 more per month in cash flow. The issue that I see is that you used 2.1 million in capital that you had already paid the capital gains tax on (say 2.7 million) to create $9000 in cash flow.

The reason why I probably have not seen this strategy used by many real estate entrepeneurs is what I will talk more about in the aricle “Sell Some Assets and Private Lend the Money for Financial Independence (Retirement).”

These are the eleven ways that I have seen real estate entrepreneurs use their properties to retire:

Using Real Estate for Financial Independence (Retirement) <–start here

Cash Flow from your Property Portfolio for Financial Independence (Retirement)

Sell Some Assets and Pay Off the Rest for Financial Independence (Retirement) <– you are here

Sell Some Assets and Private Lend the Money for Financial Independence (Retirement)

VTB Mortgages on Apartment Buildings then Private Mortgages for Financial Independence (Retirement)

Sell All Assets and Invest in Lower Return Investments for Financial Independence (Retirement)

Have a Trophy Asset/s and Sell Off Other Assets for Financial Independence (Retirement)

Refinance Assets Annually from your Property Portfolio for Financial Independence (Retirement)

Invest in Other People’s Deals for Growth for Financial Independence (Retirement)

De-accumulation of Assets Over Time for Financial Independence (Retirement)

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Why Paying Off Your Principal Residence Still Makes Sense for Ontario Real Estate Investors

Why Paying Off Your Mortgage Might Be Hurting Your Wealth – A Wake-Up Call for Ontario Real Estate Investors

Risk and Reward As A Real Estate Investor

Using Real Estate for Financial Independence (Retirement)

Sell Some Assets and Private Lend the Money for Financial Independence (Retirement)