- You are here:

- Home »

- Blog »

- Use Real Estate for Financial Independance »

- Cash Flow from your Property Portfolio for Financial Independence (Retirement)

Cash Flow from your Property Portfolio for Financial Independence (Retirement)

When we talk about cash flow it’s important to also get an understanding of the different types of real estate markets out there. Some people categorize a market as a cash flow Market. When the categorize Market as a cash flow market usually that means that there is little appreciation that happens to the properties in that area but the cash on cash number that people achieve is higher.

A market that has appreciation usually has very little cash flow. That means that the bulk of the wealth that comes from the asset is not based on cash on cash rather the appreciation of that asset over time.

Ideally you would want to invest in an area that has both cash flow and appreciation therefore you would get the benefits of Both Worlds. That often means that investors are challenged to find cash flowing properties in appreciating markets.

Not all markets in Ontario would be considered appreciation markets. But quite a few of the markets in the Golden Horseshoe would be considered appreciation markets. The challenge that investors have is finding cash flow of those assets.

Usually the real estate entrepreneurs who I have been talking to have owned these properties for 10 years or more. They are not new investors. That usually means that their mortgage is often less than 50% of the value of the property.

Now when I’m referring to cash flow I’m referring to profits that are achieved at the end of the month or the end of the year after all of the hard costs and soft costs are paid by investors. This does not include mortgage pay down.

Let’s say rent that was collected was $5,000 on a duplex per month. And the mortgage payment that includes principal and interest is $2,000 per month. And the insurance is $150 per month. And the property taxes are $300 per month. Let’s say the property management fee that you are including is $500. You will also have maintenance repairs and vacancy costs that you would include depending on the age and type of property that you have. For Simplicity sake let’s call this number 15%, so in this example there would be $750 per month set aside for vacancy and repairs. In this example the property cash flows about $1300 per month.

Oftentimes where the challenges arise are in rent controlled markets like Ontario. This often means that rents can never be brought up to whatever the current market rent is. All things being the same if you are in an Appreciation Market, that is not rent controlled you have the ability to continue to rent these properties longer.

Rent controlled markets usually makes real estate entrepreneurs sell their properties instead of continue to rent them because they cannot get the market rents that they want and they are often sitting on hundreds of thousands of dollars in equity particularly if these are single family homes. As these are often sold to homeowners and are removed from the rental stock.

With a small portfolio of less than 10 properties and I have often seen this self-managed rather than managed by third party management. Often these owners don’t have any partners on these properties either, they are owned 100%. They use the additional income that would have gone towards property management for their own cash flow.

If there is a larger portfolio say 20 or more 1-4 unit properties then they are often managed by a third party management company. This just allows the owners to travel more, but because they have owned their properties for a long time they still generate the cash flow that they require.

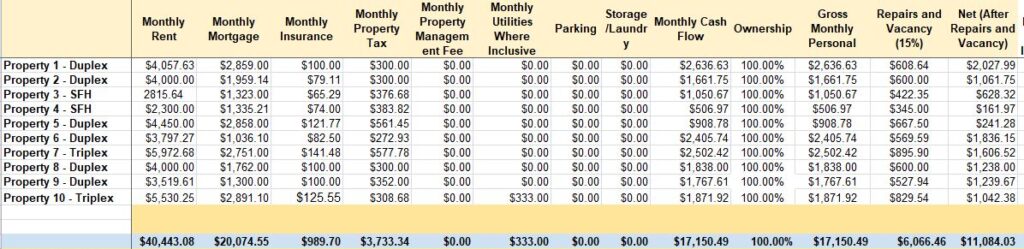

Here is an Example:

But in this example we have a couple that is looking to pass along these properties to their different children. And have a portfolio of less that 10 properties that they will use to generate cash flow. They are self managing the properties and keeping the cash flow,

These are the eleven ways that I have seen real estate entrepreneurs use their properties to retire:

Using Real Estate for Financial Independence (Retirement) <–start here

Cash Flow from your Property Portfolio for Financial Independence (Retirement) <– you are here

Sell Some Assets and Pay Off the Rest for Financial Independence (Retirement)

Sell Some Assets and Private Lend the Money for Financial Independence (Retirement)

VTB Mortgages on Apartment Buildings then Private Mortgages for Financial Independence (Retirement)

Sell All Assets and Invest in Lower Return Investments for Financial Independence (Retirement)

Have a Trophy Asset/s and Sell Off Other Assets for Financial Independence (Retirement)

Refinance Assets Annually from your Property Portfolio for Financial Independence (Retirement)

Invest in Other People’s Deals for Growth for Financial Independence (Retirement)

De-accumulation of Assets Over Time for Financial Independence (Retirement)

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Using Real Estate for Financial Independence (Retirement)

Sell Some Assets and Private Lend the Money for Financial Independence (Retirement)

Convert Real Estate Portfolio Into a REIT or Fund for Inter-generational Wealth and for Financial Independence (Retirement)

VTB Mortgages on Apartment Buildings then Private Mortgages for Financial Independence (Retirement)

Sell Some Assets and Pay Off the Rest for Financial Independence (Retirement)