All posts by Quentin DSouza

Staying Open-Minded: A Key to Success for Ontario Real Estate Investors

In my experience in the Ontario real estate world, where things constantly change and new opportunities pop up, I’ve found that keeping an open mind is absolutely essential. It’s not […]

Continue readingWho Should Not Be Buying a Small Apartment Building in Ontario?

We’ve recently discussed the compelling reasons why investing in small multi-family buildings, especially if you have experience with one to four unit properties, can be a smart move. But today, […]

Continue readingPassive Investment Strategies Yielding 10%+ Returns: DurhamREI Member Survey

As real estate investors mature in their journey, many shift their focus from growth to income. At DurhamREI, I wanted to understand how our experienced members are achieving 10%+ cash-on-cash […]

Continue readingWhy Paying Off Your Principal Residence Still Makes Sense for Ontario Real Estate Investors

I shared the article “Why Paying Off Your Mortgage Might Be Hurting Your Wealth – A Wake-Up Call for Ontario Real Estate Investors.” I wanted to write on the other […]

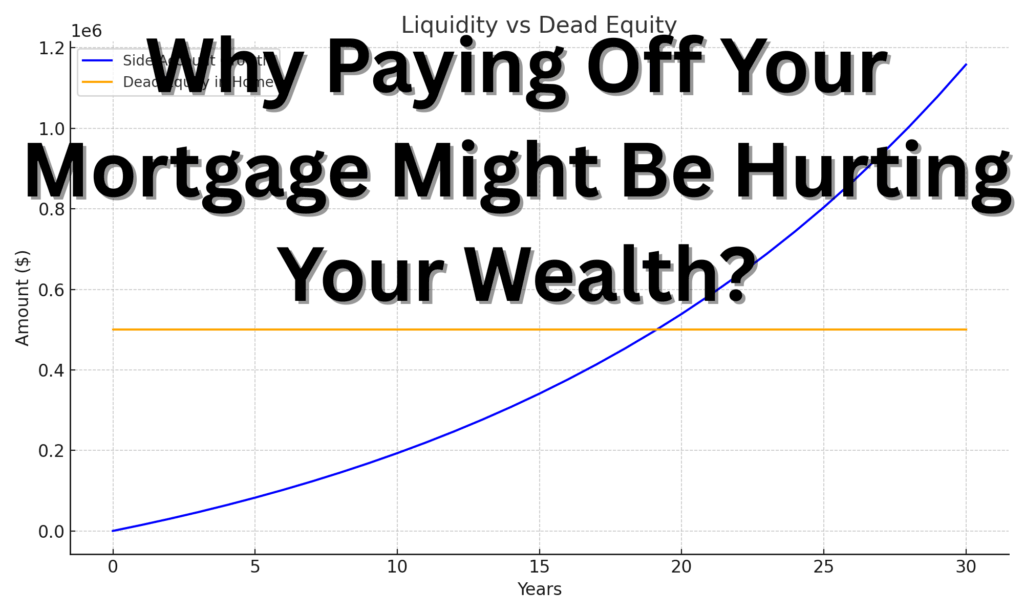

Continue readingWhy Paying Off Your Mortgage Might Be Hurting Your Wealth – A Wake-Up Call for Ontario Real Estate Investors

I shared the article “Why Paying Off Your Principal Residence Still Makes Sense for Ontario Real Estate Investors.” I wanted to write on the other side of not using the […]

Continue readingWhat If You Could Buy Just One Apartment Building in The Next 12 Months?

What If You Could Buy Just One Apartment Building in The Next 12 Months? Most real estate investors never purchase an apartment building; instead, they focus on one—to four-unit properties. […]

Continue readingOntario Real Estate Investment Outlook 2025

For real estate investors in Ontario, 2025 presents a dramatically different landscape than recent years. According to the 2025 Canada Rental Market Trend Report by Liv Rent, Ontario’s average monthly […]

Continue readingYou Should Only Listen to Mentors and Teachers Who Have Already Succeeded at What You Want to Do

Would you ever have a heart surgeon who only read about heart surgery and learned videos online about heart surgery but has never done an operation work on you? Then […]

Continue readingThe Weekend Guru

In April 2008, I attended a quick start real estate investing weekend with the Real Estate Investment Network(REIN) for $287. It opened my eyes to the potential of investing in […]

Continue readingDo Interest Rates Go Down Faster Than They Go Up?

One of the trends that I have heard from mortgage brokers is that interest rates usually go down faster than they go up. As a real estate investor, I’m interested […]

Continue reading