- You are here:

- Home »

- Blog »

- Building Wealth »

- Phases of Real Estate Investing

Phases of Real Estate Investing

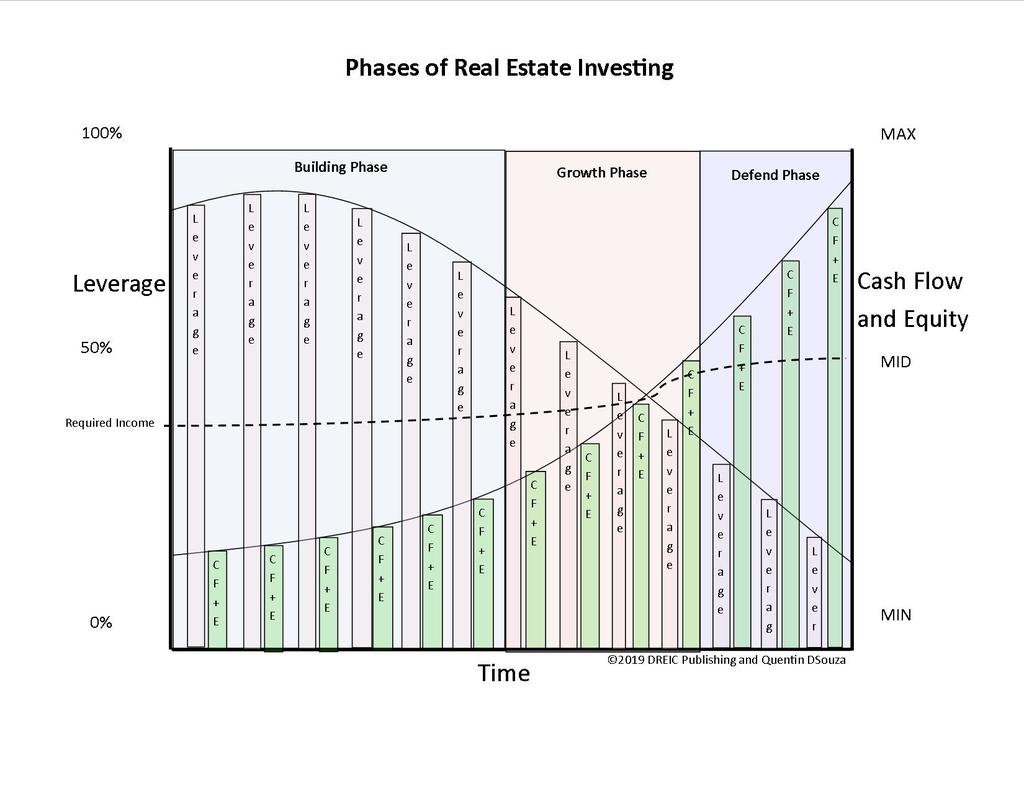

Many investors go through three distinct phases while investing in real estate. Of course this will depend on your goals. For example if they are planning on using the funds as their primary income source. How these investors do their purchases and think of investing is quite different and distinct, depending on the phase that they are in. There are many ways that you can skip through phases. If you are just starting out in investing most likely you start in the building phase, unless you have inherited a number of rental properties then that might push you into the growth phase.

Required Income

The required income is the income that is necessary for the real estate investor to survive that would include income that is necessary for food, transportation, housing as well as all the necessities in life. This amount increases over time with inflation and can change depending on the person and how they live. Typically you see that the real estate income surpasses the required income at some point in the growth phase of the real estate investing journey.

One thing to keep in mind, the phases on investing are really looking from the lens of buy-and-hold perspective. Other types of income like rent-to-owns, flipping, wholesaling, lending are more active job like income then less passive buy-and-hold investments. Or these strategies require you to continue to purchase or find new assets to replace existing ones.

The Building Phase

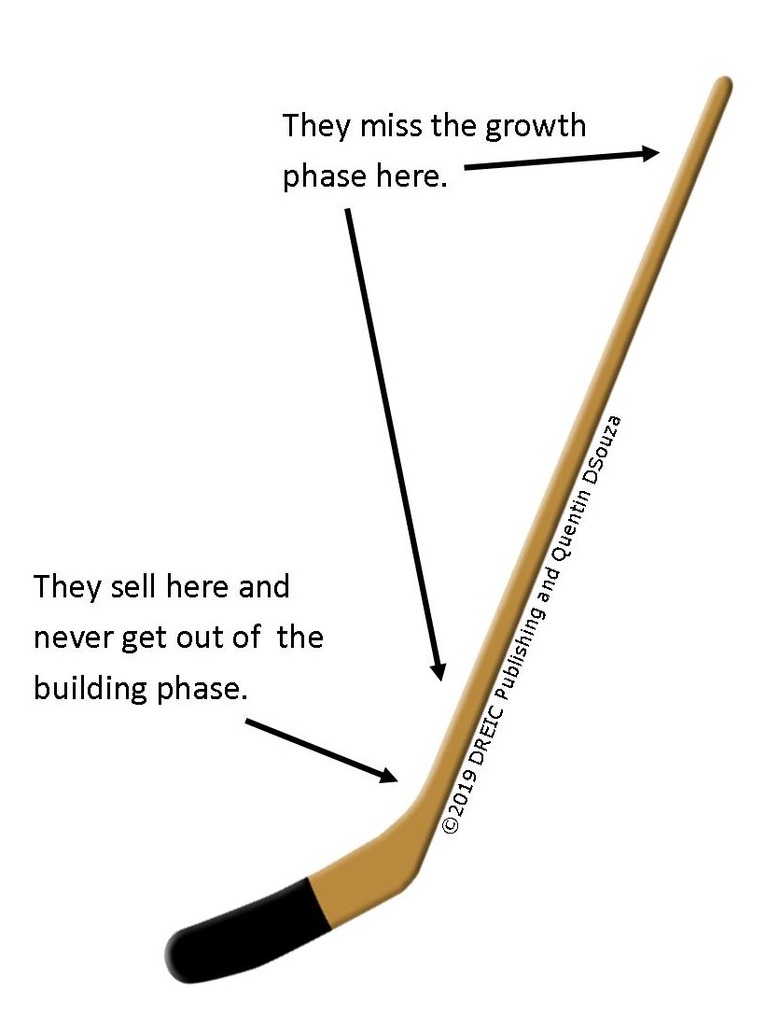

What is distinctive about this stage is that the shear number of investors who never make it out of this phase. Like one very smart real estate investor and friend told me a long time ago. The investors who never get out of this phase sell at the base of the hockey stick. And never realize the much bigger gains that happen in the growth phase on the shaft of the stick.

Leverage is much higher in this phase and the amount of cash flow and equity is lower in the building phase. At this stage many investors will purchase 1-3 properties and will either start building their team, processes and procedures in order to build a real estate business or become a solo investors and focus on doing all the tasks themselves. If the real estate investor focuses on doing all of the roles themselves, it will take years before they move into the growth phase of their investing. Others who learn to build a business, get education, use mentors, hire a team, and move into adding processes and procedures will move quickly into the next phase.

The Growth Phase

This phase comes with a change in the amount of cash flow and equity that is generated from the real estate business. Often, but not always, leverage starts decreasing and equity and cash flow increase. This can be characterized by equity and cash flow exceeding the amount of mortgages in the portfolio.

In the growth phase the return on equity is often decreasing. That does not necessarily mean that real estate investors are deleveraging. They may continue to recapitize on equity through refinances, selling assets or using secondary financing to build and grow their real estate portfolio.

Often the growth phase is characterized by more advanced purchase and financing strategies, as well as the ability to use co-venture partnerships, in order to help with the building in the initial growth phase. Often in the midst of the growth phase is where we see the required income surpassed by the income from the real estate portfolio, as well as from other streams of income.

The Defend Phase

This stage is where you will find older real estate investors who have been investing for a long time. Their mortgages are often below 50% of the value of the property, and have lots of equity because of that. These investors receive solid cash flow from their properties. Usually these real estate investors are enjoying the fruits of their labour or doing one of three things – giving other investors in the building phase vendor-take-back mortgages or in the process of selling various assets to liquidate or structuring their real estate portfolio in order to pass on their real estate assets and help their children or heirs skip the building phase and move directly into the growth phase of investing.

Where Are You?

Depending on where you are in your real estate investing journey will affect the decisions that you make when it comes to strategy, financing, taking on partnerships, growing your portfolio, or investing in different areas.

What I have noticed about the real estate investors that continue to succeed in moving into different phases is that they are always taking action, continually interested in learning more, work on developing themselves and growing in new and different ways. This is particularly definitive characteristic of real estate investors who are moving from the building to the growth phase or the growth to the defend phase.

If you are serious about becoming a full-time real estate investor it’s possible to move into the growth phase in five years or less depending on your commitment level and the actions you take.

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Should You Continue to Invest in Ontario Real Estate?

Using Real Estate for Financial Independence (Retirement)

Convert Real Estate Portfolio Into a REIT or Fund for Inter-generational Wealth and for Financial Independence (Retirement)

12 Things I Learned Spending $12,000 on a Financial Plan

Unpacking Ray Dalio’s It Starts With Inflation – Key Insights