- You are here:

- Home »

- Blog »

- Building Wealth »

- The Lure of Passive Real Estate Investment Income

The Lure of Passive Real Estate Investment Income

I’m not sure how many times I have the term “passive income” and “real estate” together over the last 10 years at various events and presentations – but it is definitely a lot. It seems that many gurus tout the benefits of investing in real estate by stating that real estate is more like mailbox money that comes to you every month.

While it’s true that real estate is more passive than working a nine-to-five job there is many pieces that come to together that requires you to buy it, manage it, or sell it that are not so passive. I don’t believe there is anything that is truly passive that doesn’t require some time for you to manage it to some extent or another.

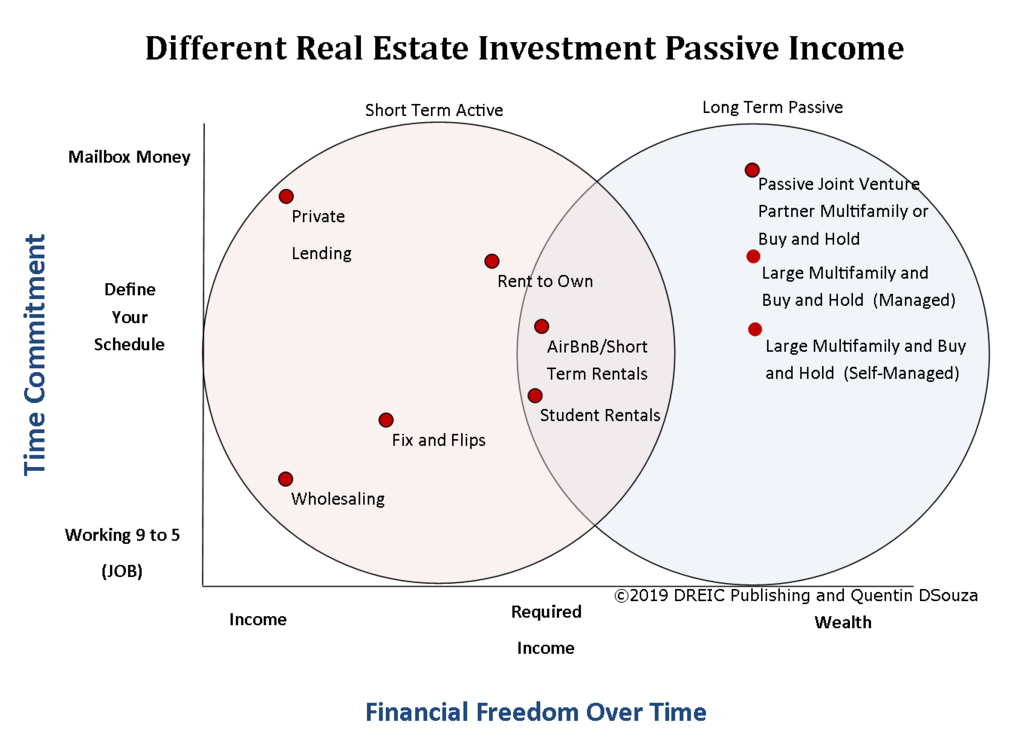

To follow up on my phases of real estate investing article, I am sharing this graph that I use to help other real estate investors understand passivity of different types of real estate investment strategies.

There are also some assumptions here – that long term for the buy and hold and multifamily strategies are greater than 10 years, are located in solid appreciating areas, with good future investment prospects, and cash flow positive assets. And short term is defined as less than five years.

While this is not a definitive guide it should help to put you into the mindset that you need when it comes to choosing a particular investing strategy in real estate. Also keep in mind there are always tools, team members, and techniques that will help you to minimize your workload and help your real estate empire run smoothly. But that does not eliminate your requirement from managing those things. In fact if you don’t manage those three things then it will affect the success of your real estate business.

On the left hand side of the graph “Time Commitment” helps to identify the amount of work necessary to carry out the strategy. So if it more job-like it will be lower down on the chart, if it is closer to mailbox money the time commitment is less so it appears higher on the graph.

The bottom of the graph “Financial Freedom Over Time” helps to identify whether the strategy is focused on income or focused on long-term wealth. Income is not wealth itself but is part of the process. It is that amount of money that someone receives on a regular or semiregular basis. Wealth for our purposes is related more closely to net worth, and is often a byproduct of high income producers, but not necessarily.

It is impossible for me to encapsulate every variation of every strategy and put it on the graph. This is only an interpretation.

It is certainly possible to have some strategies that started off as income but turning to long-term wealth. For example, you might have a rent-to-own where the tenant buyer does not purchase using the option agreement and the property turns into a long term rental. It is also possible to have strategies like air bnb/short term rentals/ and student rentals have long term passive components. That is why they overlap in the center of the graph.

Short Term Active

So when we look at the short term active real estate investment strategies, we are looking at the amount of work to income generated. Let’s look at a couple of these strategies in order to understand what I mean by short-term.

Wholesaling is a strategy that is often something that you hear in courses that are sold by real estate education companies as a beginner strategy. You basically get an undervalued property with equity under contract with the seller and assign it to another buyer for an assignment fee, which could be $1000 to 25,000 or more. But the amount of work required to get wholesaling business going and focusing on the strategy really requires a lot of day-to-day effort, consistent marketing and networking. Those who do it successfully are often quite busy, and usually use other strategies in conjunction with the lead generation that comes from wholesaling. They might do a fix and flip project or add a long-term buy-and-hold rental to their portfolio.

Let’s face it fix and flip projects are one of the sexiest types of real estate investing. That’s why you see it on all the television shows. Make big money now is the perception. Anyone who mentions that they are flipping a property at a meeting, seems to get instant respect. Basically what you’re doing is taking house that needs work, increasing the value of the property and then reselling it quickly, hopefully for a profit.

Often private lending is one of the most passive of the active income category, depending on the length of time that you are lending funds. One of the challenges with lending is that you are constantly seeking new projects to lend on because the borrower exits the mortgage. The lender then must seek another project and do their due diligence to lend again. There are always ways to make it more passive by using a mortgage agent or broker or mortgage investment corporation. Although you have to watch out for the taxes if you aren’t structured properly. The higher amount that you are lending the more you move to the right in the income category as compared to other active strategies.

Long Term Passive

Long term passive strategies are really buy-and-hold projects that are held for a long period of time. The amount of capacity usually depends on whether the properties are self-managed or managed by a professional property management company. Even though there may be a professional property management company working the long term passive investors still must manage the company.

The most passive in the long term wealth category is a passive joint venture partner. That basically is somebody who is providing the financing and/or funding the real estate project but doesn’t take an active role in the day-to-day management of the asset. Just like having a property manager you need to take some time to manage your joint venture partner.

Do you agree or disgree with the chart? Let me know in the comments below.

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Should You Continue to Invest in Ontario Real Estate?

Using Real Estate for Financial Independence (Retirement)

Convert Real Estate Portfolio Into a REIT or Fund for Inter-generational Wealth and for Financial Independence (Retirement)

12 Things I Learned Spending $12,000 on a Financial Plan

Unpacking Ray Dalio’s It Starts With Inflation – Key Insights