- You are here:

- Home »

- Blog »

- Ontario Market Information »

- The Elimination of Private Rental Housing in Ontario: Financing (Part 1)

The Elimination of Private Rental Housing in Ontario: Financing (Part 1)

With vacancy rates less than 1% in most areas in the Greater Toronto Area and rents increasing across the province, politicians are facing a real challenge.

Over the coming weeks I will share some insights into different areas of the private rental housing industry with a series of articles that focus on the Ontario and Greater Toronto Area markets specifically.

In this article I will share some background on the rental market and a few key pieces of data that policy makers seemed to have missed or not addressed. This information comes from numerous discussions with industry professionals: mortgage brokers and agents, bank mortgage specialists, accountants and real estate brokers from various regions.

Some Historical Context

In the 1960’s and early 70’s, when a majority of the large rental housing apartment projects were completed, builders had several government subsides, capital cost write-offs for for the purpose of building rental apartments. At the time, 60% of building permits being issued were for multi-family rental dwellings and vacancy rates hovered around 6%.

A vacancy rate of 3% is considered balanced market, whereas a 1% vacancy rate is considered critically low. A city that has a 5-6% vacancy rate is one where tenants have more choice of rental units, could expect rental incentives, and have more flexibility on rental rates.

In the 1970’s these rental construction subsidies disappeared and there was a new focus on incentives for home ownership at different levels of government. This lead to a reduction in rental housing construction by 77% in 1973-74. It also lead vacancy rates to drop from close to 6% in the 1960’s and early 70’s to close to 1% in 1974. The vacancy rate proceeded to stay below 2% in Toronto for the next 25 years.

In 1975 rent control was implemented in Ontario as a lack of supply created an environment of rising rental rates, which became a major political issue at the time.

In simple economic terms, we understand that price is a function of supply. As such, rental rates are a direct function of the available supply of rental units. More supply will always mean lower rents. Less supply will always mean higher rents.

Changes in Financing

Over the last decade the federal government and provincial governments have introduced various policy changes to mortgage financing rules in an attempt to cool a real estate market that enjoyed several years of low interest rates and double digit appreciation. As a result of these changes it has become very challenging for private rental housing providers to finance their projects and properties. The private rental housing market is currently around 30% of Canada’s total housing stock.

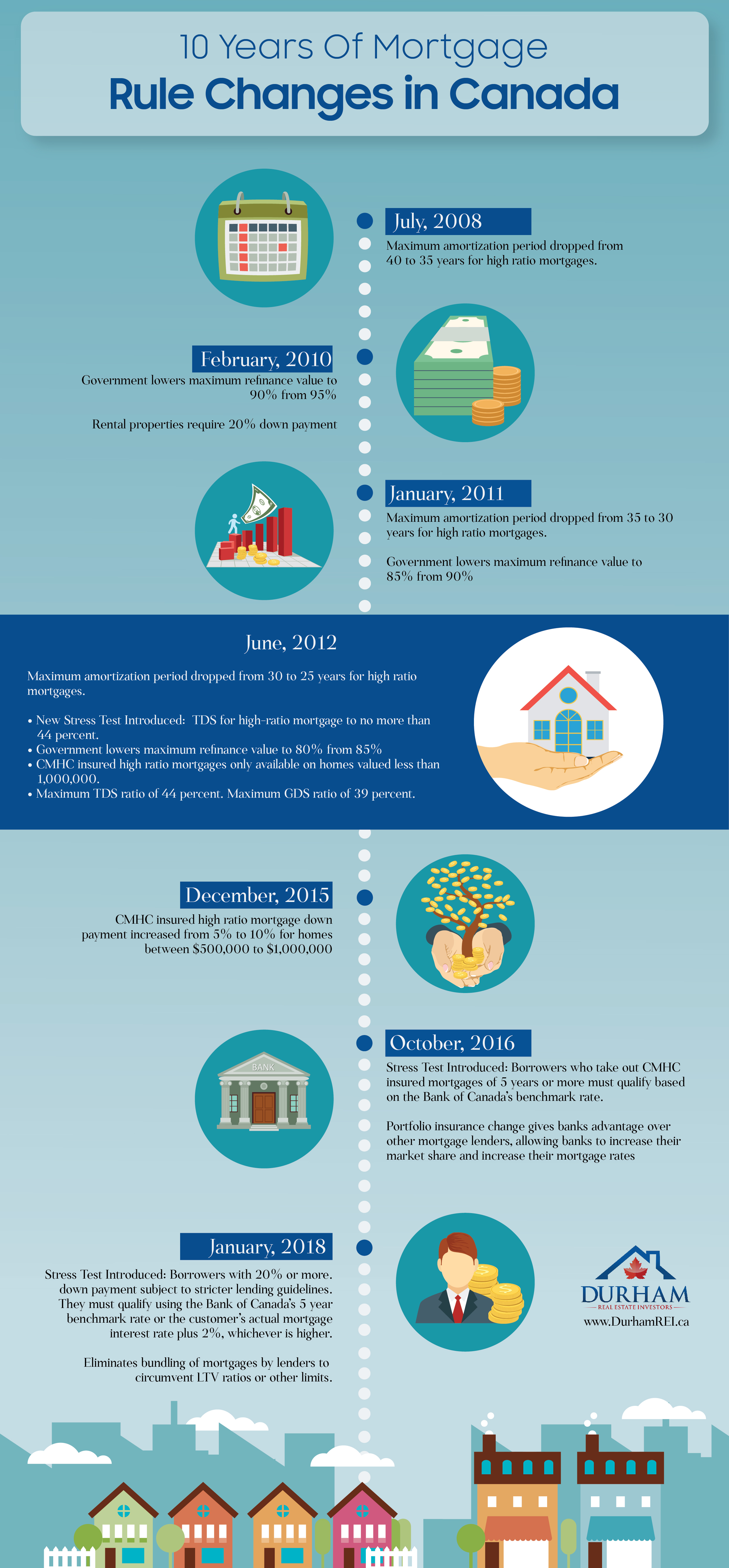

Much of the financing policy changes over the last 10 years that have been implemented have focused on reducing the demand for housing. By changing qualification rules, policy makers can put the breaks on the demand side of the equation, to keep house prices down, and create an environment that would prepare for rising interest rates. You can see these changes illustrated in this infographic.

Keep in mind however the number of mortgage areas in Canada has never exceeded 0.65% in the last 30 years according to the Canadian Bankers Association; even when interest rates were at 14% in the early 90’s. Compare that to the United States who saw a mortgage delinquency rate high 11.3% in early 2010 according to the Federal Reserve Bank of St. Louis, which is amazing considering the population of Canada, is smaller than the population of California.

As a by-product, these policy changes have made financing private rental properties much more expensive and difficult for most banks and lenders, who have responed by reducing or eliminating their rental property programs. This along with provincial changes like the implementation of Rental Fairness Act, have directly affected the supply of new rental housing coming on the market.

Media recently reported 1,000 units were converted to condominium units as a result to the implementation of the Rental Fairness Act in 2017. But a few key Real Estate Brokers in Toronto that I have talked to, have mentioned 6-10,000 purpose built rental housing units in the Greater Toronto Area were either eliminated or converted to condominium projects.

If you dissected investors in the private rental housing market you would see an interesting trend. Between 80 to 85% of investors have less than four properties, comprising a total of less than nine rental units. These are considered small-scale rental housing providers. The last 15 to 20%, we are referred to as professional rental housing providers.

What is important to note is that professional rental housing providers supply more than 80% of available rental units yet it is this last 20% who have been most affected by the financing rule changes in the residential space.

Differing Levels Of Financing Risk

Small-scale rental housing providers typically qualify for financing of their rental properties based on their income from their jobs and need to provide a down payment often much higher than 20% of the purchase price of a property.

Some mortgage, accounting, and finance professionals that I have talked to have estimate that almost 90% of these rental properties would be in a cash flow negative position at an 80% loan-to-value. Owners of these properties have to contribute part of their income from their jobs to support their rental property purchase and/or put a 30-50% down payment on that purchase.

Lenders are justifiably concerned about small-scale rental housing providers who are more likely to be in a position that they will need to contribute additional funds out of their pocket each month just to maintain their rental property.

Professional rental housing providers on the other hand qualify for purchases based on networth, income, liabilities, and the strength of the income from their portfolio of properties. For every $1 of expenses they have, they would be expected to generate between $1.2-1.3 dollars in rental income. In order to continue to borrow the income from their portfolio would be evaluated.

Many mortgage lenders have instituted property limits and will no longer lend to borrowers that have more than 5 residential rental properties regardless of down payments, or portfolio rental income. This limit forces investors into working with riskier strategies or pushes them out of the residential space altogether. The result is less stability, a reduction in the supply of new rental housing units, and increasing rents.

*Big thanks to Kathleen van den Berg, Steve White and others who would like to remain anonymous, for their help with facts and feedback on this article.

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Ontario Real Estate Investment Outlook 2025

Looking at Migration Patterns In Toronto

MPAC says it’s seen an 18 percent increase in property values in Ontario

Ontario Caps Rent Increase Guideline

Ontario economy expected to rise