- You are here:

- Home »

- Blog »

- Building Wealth »

- What Makes a Property, A Good Investment?

What Makes a Property, A Good Investment?

I use scorecards and a number of different tools that help me to evaluate real estate assets in order to figure out which will make a good investment and which do not. Lately, I have been talking to different investors who are caught up with finding markets that have the lowest price and highest cash flow yield.

While I believe cash flow is really important, you need to be careful that you are not basing your decision to purchase entirely on price. If you are a member, the course “Your First Million in Real Estate” discusses in greater details, the strategies for choosing the right locations to invest in. Just remember the saying,

“Price is What You Pay, Value is What You Get.”

Warren Buffet

Although having great cash flow is important, it not where you will get the highest ROI when purchasing an investment property.

So here are three big picture rules to keep in mind when deciding on a particular property.

1. Buy Land Not Air – Remember land appreciates and buildings depreciate. Over time you will find that the land under which the building sits, appreciates but the building itself will depreciate. Often appraisers and accountants will refer to this as the useful life of the building.

Let me give you the example of two properties in the same town, both are currently selling for $500,000. The first is a detached bungalow with 1000 square foot living space and 1000 square foot unfinished basement. The second is a 1000 square foot condominium tower in the same area. (For fun, you may want to expand this out and compare properties in different areas.)

The lot the detached house is worth $300,000.

The condominium tower lot value is $10,500,000 but it has 300 units in the building. If you attribute each unit with a land value it is $35,000.

Over time let’s say the building depreciates at 3% annually. The land must appreciate at least 3% annually to stay even.

If we wanted to see the properties worth $1,000,000 in 12 years then what type of appreciation would we need to see on the land value?

In order to get a value of $1,000,000 in 12 years for the first property, the building would be worth $138,768 after annual depreciation and the land would need an annual appreciation rate of approximately 9.2% in order to get that value.

For the second property, the building would be worth $322,636 after 12 years of depreciation and an annual appreciation rate of the land would need to be approximately 28% in order to get a value of $1,000,000. It takes almost triple the appreciation of the land value to get the same amount of return over a similar timeframe.

Bottom line: I like to have my land value at least 50% of the purchase price.

2. Land Scarcity – You are looking for properties in areas where there is a limited supply and in highly desirable locations.

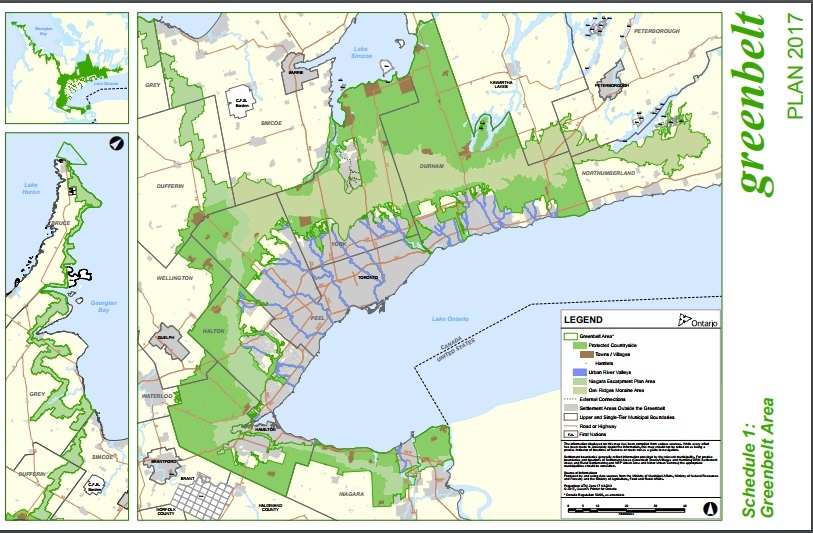

For example, in the golden horseshoe area of Ontario we have a greenbelt, that is a permanently protected area of green space, farmland, forests, wetlands, and watersheds.

Supply in this area is fixed because of Ontario’s Greenbelt Plan. The Greenbelt currently includes over 2 million acres of land that is protected. The limit of land in this area is a supply constraint.

Secondly, keep in mind the desirability of the location: parks, schools, restaurant, entertainment, good and improving transportation and infrastructure.

You are looking for assets that many people would be interested in buying not just a limited few. Having a busy street or a loud manufacturing plant next door is not going to attract a multitude of future buyers of the property. The more desirable the location of the asset, the more valuable.

Bottom line: Make sure there are many different buyers of the property.

3. Past Performance and Future Expectations – If you look at similar properties on the same street what has the appreciation rate been for the last 10 years, 20 years, or 30 years. If you look at the appreciation rate of the Greater Toronto Area the average appreciation rate is about 6.5%. But that means some properties may appreciate closer to 3% and others closer to 10%. I would be more interested in something that has appreciated more.

Get a real estate agent to look back as far as possible on a street or very close to the area that you are considering investing in and send you all the listings that they possibly can. You will then be able to get an idea what the appreciation rate has been for an area over time.

Could there be huge economic changes that effect future appreciation? Yes. And there could also be a zombie apocalypse. There is always a realm of possibility.

Looking at past performance helps to identify how the first two rules have done and tends to be more accurate than other predictors of future performance for the Golden Horseshoe area in particular.

Bottom line: Look at the track record of the property in question.

Keep building the foundation for your real estate success!

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Should You Continue to Invest in Ontario Real Estate?

12 Things I Learned Spending $12,000 on a Financial Plan

Unpacking Ray Dalio’s It Starts With Inflation – Key Insights

Beware – Dangerous Leverage Can Cause Bankruptcy

Ontario Real Estate Investors Focusing on the USA