- You are here:

- Home »

- Blog »

- Building Wealth »

- You Can Create Wealth by Using Multiple Streams of Income

You Can Create Wealth by Using Multiple Streams of Income

There are only six ways that you can create wealth. You can inherit it(1), marry it(2), win it(3), steal it(4), work for it(5), or invest to get it(6).

I’m not really interested in the first 4 ways to create wealth as I don’t see them as something that many people can reasonably expect to do or achieve. If you are part of the lucky sperm club or you marry in order to acquire wealth then this article is not for you. If you are someone who gambled and gained wealth through a winning lottery ticket, or stole from others to achieve your wealth then, this article is definitely not for you. If however you are willing to work for wealth or invest to create it, then keep reading.

You need to have a way to track and compare key performance indictors of your own personal finances in order for you to know where you are, in order to develop a plan as to where you want to go. There are really just two key performance indictors that I suggest you focus on to start off Net Worth and Cash Flow.

Total Assets – Total Liabilities = Net worth

All Income – All Expenses = Cash Flow

The way that I focus on creating wealth is through creating monthly cash flow. Net worth increases are a by-product of those who focus on increasing their monthly cash flow, and then follow the phases to creating multiple income streams.

Let me share with you three things that are preventing you from creating wealth.

Let’s say you set a goal of $30,000 of cash flow per month. A goal that This is a big hairy goal that will acquire lots of attention. Is it achieveable? Yes it is! Don’t let people who have not been able to achieve this goal themselves, tell you that it is not something that can be done. Change the people you are with instead.

It seems like the term coach is being used everywhere. When I bought my new truck the person at the dealership who sold me the vehicle was a truck coach. A great salesperson with a cool title, but not someone I would trust with giving me unbiased advice. That I needed to look elsewhere.

1. Stop listening to advisors, coaches, consultants and other so called professionals that have not already achieved the wealth that you want using a particular method or strategy, they will only take you on the road they have been on but no further.

Would you like to have $500,000 in the bank cash? Ask someone who already has $500,000 in the bank cash. Will it take work to find that person? Sure it will. Will it be better advice that you will get from other people? You bet it will. If they are using method five or six to create wealth, listen extremely carefully.

2. Stop listening to the personal finance gurus that tell you that all debt is bad. Learn the difference between good debt, bad debt, and have room for opportunity with debt.

When debt is used correctly it can be a power tool that can leverage your success in order to acheive cash flow and net worth goals faster than you ever thought possible. Use debt incorrectly and it can have the opposite effect on your finances. Taking the time to educate yourself about good debt is an important part of the process of creating wealth. You will not become wealthy by saving money, so debt is a key tool that you must learn to use.

3. Stop listening to those advisors, coaches, consultants other so called professionals that tell you not to put all your eggs in one basket.

This is one way you are being brainwashed being part of the middle class. Those who are telling it to you, believe that you are too lazy and not willing to do the work to ensure that you do the proper due diligence and understand risk. They want you to play the long and safe game. Remember to ask your financial advisor what their job is. For a majority, it is not to make you wealthy today, but to perserve your wealth into old age – big difference! If you diversify you will “need the help of a professional” and hiring that expert will cost you.

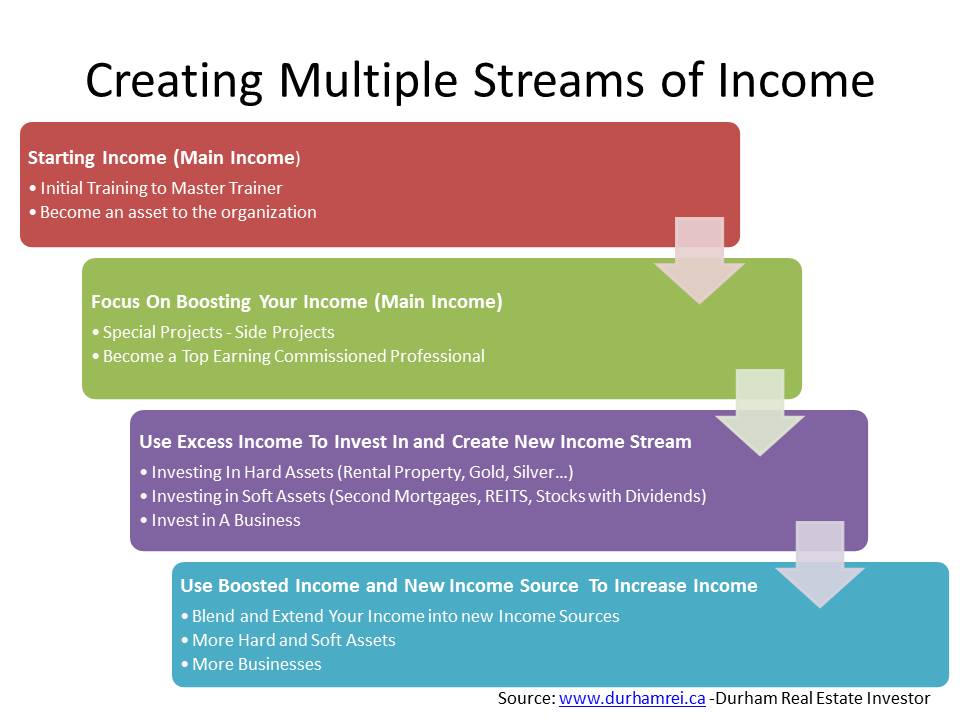

Here is a simple method that you can use to increase your cash flow, and create multiple streams of income.

Phase One: Starting Income

This is where you start earning money. I think that any income is good income and a good starting point. I don’t agree with those who immediately push others out of their jobs or pr

ofessions. Having a good income is an important part of creating wealth. One of the ways that you can do this is to focus on the job or profession that you’re already in. Move from being a beginner or starting position in to the expert or person that is more like the master trainer. Don’t be someone who avoids every new idea, but somebody who is an asset to the organization that you are currently a part of.

Phase Two: Boosting Your Income

This is where you could focus on areas in line with your main income but provide additional income to you. This might involve special projects or initiatives within your organization that could lead to additional income. If you are a commissioned professional then this would be focusing on your craft and trying to achieve the top earning potential for the position.

Phase Three: Use Excess Income to Invest In and Create New Income Stream

This is where you would convert some of the excess income from your initial boosts in phase two into new income streams for phase three. This could be investing in hard assets like rental properties, gold, silver or into soft assets like stocks, second mortgages, REITS or other paper investments. This could also be investments into a business, being careful that this isn’t buying another job but actually investing in a business.

Phase Four: Use Boosted Income and New Income Sources to Increase Income

This is where you would blend and extend your boosted income and new income source in order to create additional hard and soft asset investments. This could also mean additional investments in new businesses or in other joint venture opportunities.

Each person will be in a different phase.

If you are stuck in a phase then you have a big problem.

You need to take massive action and not do what you have always done.

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Why Paying Off Your Mortgage Might Be Hurting Your Wealth – A Wake-Up Call for Ontario Real Estate Investors

Unlock Your Portfolio’s Potential: Why Future Value is Your Crystal Ball

Stress Testing Your Real Estate Portfolio This Summer

Passive Investment Strategies Yielding 10%+ Returns: DurhamREI Member Survey

Why Paying Off Your Principal Residence Still Makes Sense for Ontario Real Estate Investors