- You are here:

- Home »

- Blog »

- Building Wealth »

- Should You Continue to Invest in Ontario Real Estate?

Should You Continue to Invest in Ontario Real Estate?

I was picking up my truck from the shop, when a gentleman came over to ask me a question as I was leaving. He recognized me as the real estate guy from the Durham Real Estate Investor meetings. Let’s call him Jim to make things easier.

Jim has about 30k left to pay off on his mortgage and he bought his house 10 years ago and was interested in buying a second home as a rental property. He spent many years working paying down the debt on his principal residence and had done an amazing job. He can’t really get his head around purchasing a new property at the current prices and then taking on more debt.

I explained the concept of good debt, bad debt and opportunity debt. Good debt helps you to earn money. You would have good debt that helps you buy a rental property that creates monthly income and an asset on your balance sheet that continues to earn.

Bad debt is essentially putting your money into something that is neither paying off the loan nor earning you any income. This could be paying for a vacation or meals on a credit card without the ability to pay it off at the end of the month.

Opportunity debt could be a line of credit, not necessarily a credit card that you can use to buy good debt in the future. The interest on that good debt can be written off, it’s a tax deduction. Often you are taking opportunity debt, moving it to good debt, you can write off the interest.

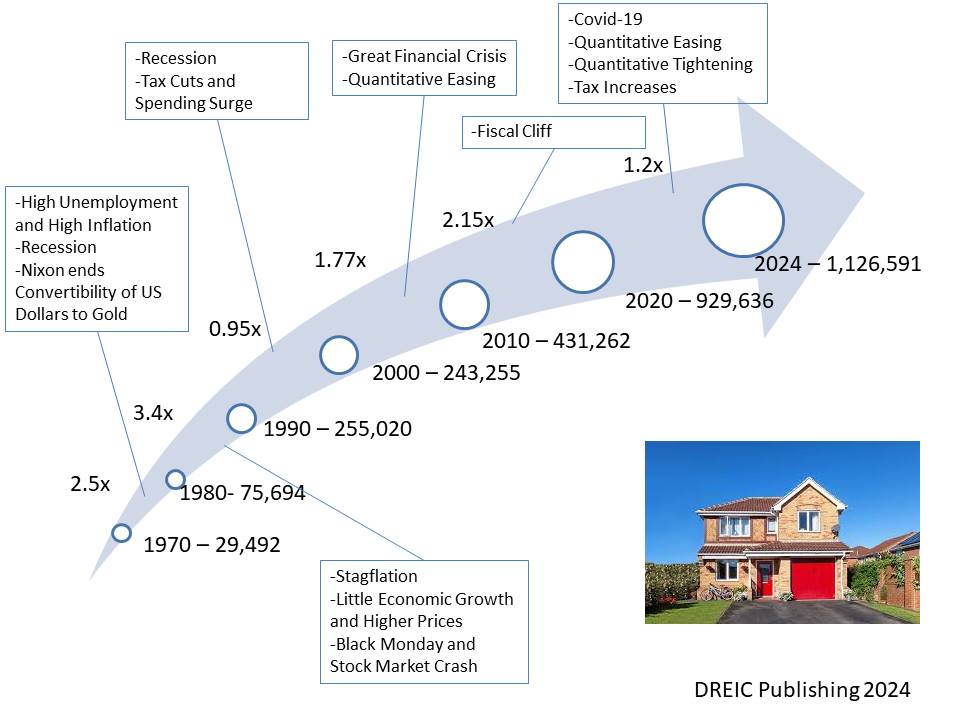

Jim was unsure that the price of a new rental property would be worth more in the future. I asked him to look at the house he bought and what the price of it was in 1970, 1980, 1990, 2000, 2010 and then today. While I don’t have a crystal ball, I can only look at the past in order to make a best guess as to what the future will hold for house prices.

The graphic above I looked at the average price of a house in the Greater Toronto Area over time. You can see that over most decades the prices close to double or more than tripled. In the 1990s prices basically stayed the same, but with mortgage pay down over that decade there would still be equity created. There were different economic conditions, as well as financial events that occurred over this period of time. I added a few notable events into the chart.

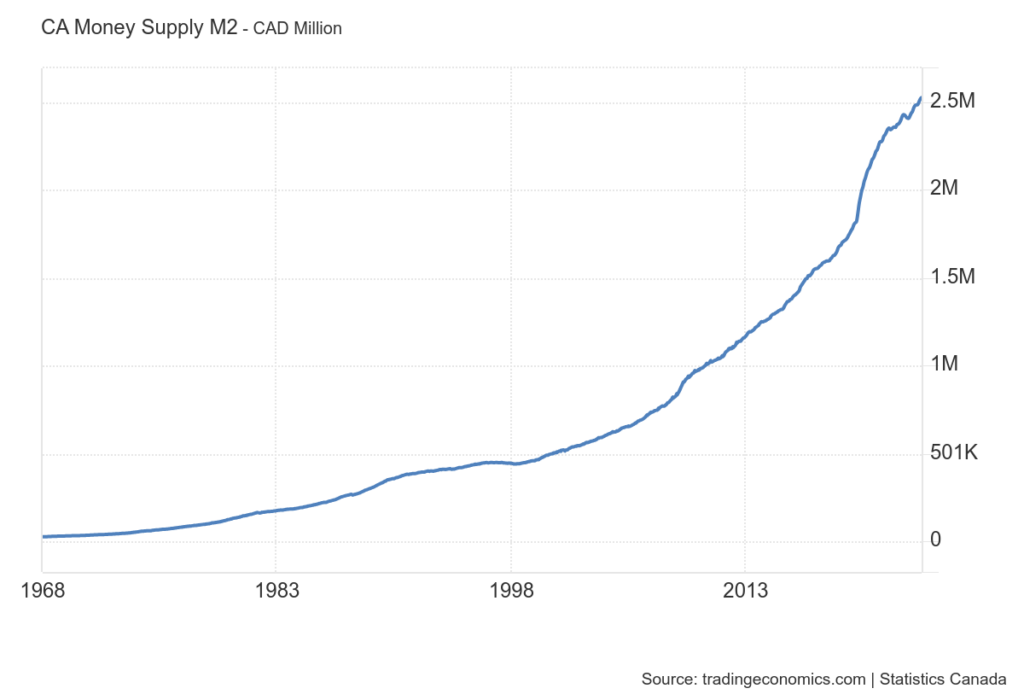

We have a Federal, Provincial and Municipal governments that seem to want to continue to spend regardless of the consequences. This spending comes from taxes, but also is reflected in the expansion of the money supply, which will continue to push up prices.

While Jim will need to make his own decision whether to purchase a rental property or not, if you are thinking in decades rather than just a year or two, you can do well with real estate ownership over time.

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Stress Testing Your Real Estate Portfolio This Summer

Staying Open-Minded: A Key to Success for Ontario Real Estate Investors

Who Should Not Be Buying a Small Apartment Building in Ontario?

Why Paying Off Your Principal Residence Still Makes Sense for Ontario Real Estate Investors

Why Paying Off Your Mortgage Might Be Hurting Your Wealth – A Wake-Up Call for Ontario Real Estate Investors