Risk and Reward As A Real Estate Investor

I have been investing in real estate for over two decades, and the one thing I have seen happen repeatedly is Real Estate Investors get over their head with a big project that takes them out of real estate investing. This could be through personal bankruptcy, corporate bankruptcy, securities investigations, or other similar events. There will always be some projects that do well and others that don’t do as well, but what I am referring to here are instances that force people out of real estate investing altogether. This is often when you hear about the metaphor, “When the tide goes out, you see who is swimming naked.” When the real estate market shifts, you see who is in trouble and who remains profitable. But why does this happen, and is there a way for us to protect against it?

You might consider real estate investment risky if you are not a real estate investor. You have heard the stories of that friend or relative who lost it all in real estate. Those stories seem to be told and retold in the mainstream. These are not the stories of the people who are good investors, who have done well and continue to invest the same way. Good news never sells, and you don’t hear these stories.

As someone who has done some pretty amazing hikes climbing Kilimanjaro, Machi Pichu, and Everest Basecamp in recent years, I know many inexperienced non-hikers might consider these risky. Still, just like real estate investors, there are things we do that are different that help to prepare us for these risks. We go on long hikes before the trek for weeks or even daily. We hiked with groups and used experienced guides to reduce the risk. It is all the preparation that you don’t see. Those who fail often do not have the proper preparation.

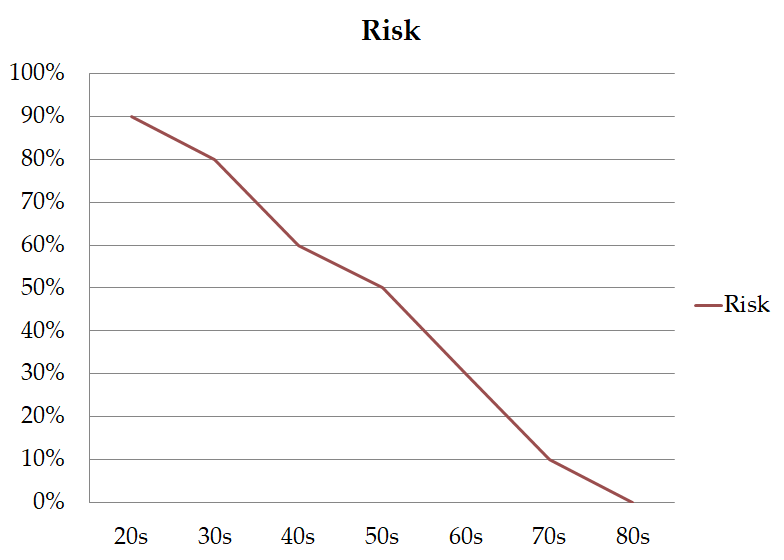

First, it’s easier for us to recover from mistakes and missteps when we are younger than when we are older. When you are younger, if you make a mistake, you have the years to recover from that mistake and make another attempt. As you age, the amount of time you have to recover from an error diminishes. You will not be able to recover in the same way when you are older and should be very careful of your risks, as they can take you out permanently from what you are doing.

If you are going on a big hike or trip, you avoid risk in areas unrelated to your field of expertise. My Everest Basecamp trip was in May 2024. I had the opportunity to do some downhill skiing but avoided it because it wasn’t in my field of expertise. It wasn’t worth the risk of getting injured and messing up my ability to take the Everest base camp trip. If I had been 30 years younger, I might have done the skiing because I felt that I could recover if I had been injured and still do the trip.

After I came back from completing Basecamp, I decided to try wake surfing for the first time and ended up with a 2nd degree tear of one of my glut muscles. I had to triple my efforts on recovery using a combination of expensive supplements, stretching, and physio to get back on track. Again, my recovery would have been much quicker and easier 30 years earlier.

I have often seen real estate investors do projects outside their expertise zone to try something exciting and new. Still, it derails them in the successes that they were already achieving. They were getting bored with how easy and simple their successful real estate process was working, and they felt the need to do something much more significant or allowed them to brag about their success rather than do something they knew was working.

Some examples I have seen are moving from infill to large housing developments, doing simple local projects to development projects out of province or another country, and moving from flipping houses to ground-up development.

I have also seen older people who have not saved as much as they should have for retirement try risky real estate projects without much support and lose the funds that they had saved for retirement altogether. For example, they had never done any private lending before. They decided to “get into it”. They were offered a 14-16% interest rate because they needed it to catch up on their lack of retirement savings.

I’m not saying you should not take risks in sports, business, or real estate investing. Some rewards come from these risks. Invest time to educate yourself from those who have already achieved what you want to achieve, and it will help you to avoid mistakes, especially if you are going done the path of doing a much larger project than you have done in the past or something much different than your current real estate experiences.

About the Author Durham REI

The Durham Real Estate Investor club began in 2008. Whether you are just starting your journey, have been investing for a few years, or are a well seasoned real estate investor the Durham Real Estate Investor Club has many benefits to you.

Related Posts

The Dunning-Kruger Effect in Real Estate

Stress Testing Your Real Estate Portfolio This Summer

Staying Open-Minded: A Key to Success for Ontario Real Estate Investors

Passive Investment Strategies Yielding 10%+ Returns: DurhamREI Member Survey

Why Paying Off Your Principal Residence Still Makes Sense for Ontario Real Estate Investors