- You are here:

- Home »

- Blog

Ontario Real Estate Investment Outlook 2025

For real estate investors in Ontario, 2025 presents a dramatically different landscape than recent years. According to the 2025 Canada Rental Market Trend Report by Liv Rent, Ontario’s average monthly […]

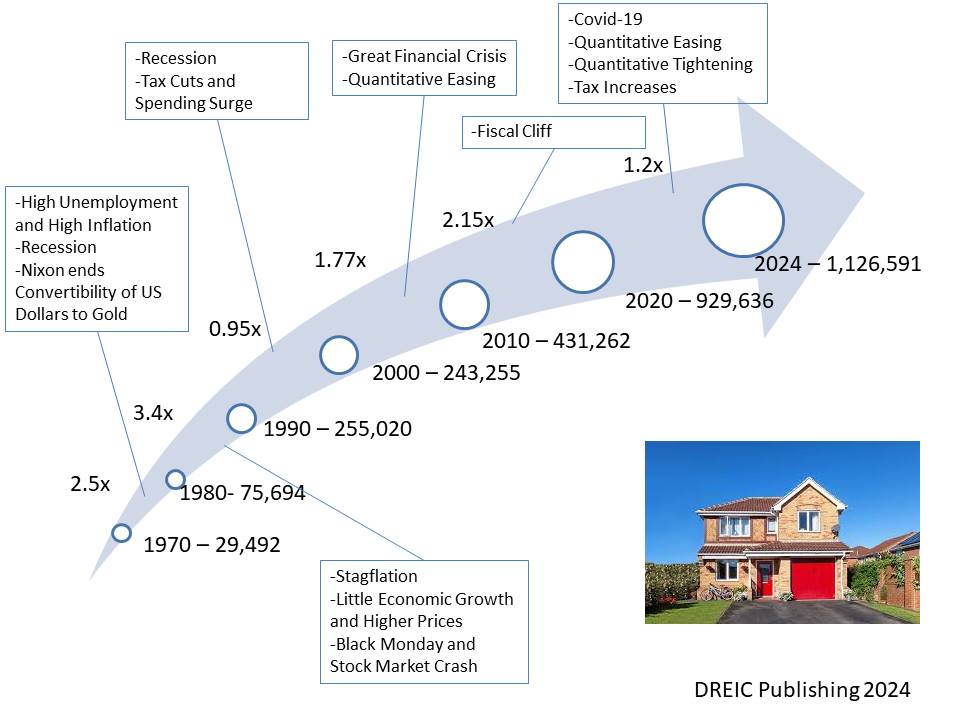

Continue readingThe Power of A Long-Term Perspective

A long term perspective when investing is a crucial financial decision, and the environment in which we make these choices can significantly influence our success. When attending a DurhamREI meeting, […]

Continue readingWhat the Wealthy in Canada Understand is That…

For years, I have participated in groups like the Entrepreneurs Organization(EO), Tiger 21, and the Toronto Business Society. These groups have what I would call the top 20%—EO—to the top […]

Continue readingYou Should Only Listen to Mentors and Teachers Who Have Already Succeeded at What You Want to Do

Would you ever have a heart surgeon who only read about heart surgery and learned videos online about heart surgery but has never done an operation work on you? Then […]

Continue readingThe Weekend Guru

In April 2008, I attended a quick start real estate investing weekend with the Real Estate Investment Network(REIN) for $287. It opened my eyes to the potential of investing in […]

Continue readingRisk and Reward As A Real Estate Investor

I have been investing in real estate for over two decades, and the one thing I have seen happen repeatedly is Real Estate Investors get over their head with a […]

Continue readingDo Interest Rates Go Down Faster Than They Go Up?

One of the trends that I have heard from mortgage brokers is that interest rates usually go down faster than they go up. As a real estate investor, I’m interested […]

Continue readingShould You Continue to Invest in Ontario Real Estate?

I was picking up my truck from the shop, when a gentleman came over to ask me a question as I was leaving. He recognized me as the real estate […]

Continue readingUsing Real Estate for Financial Independence (Retirement)

A lot of the articles that I have seen that talk about using real estate for retirement usually comes from people who focus on investing in the stock market or […]

Continue readingSell Some Assets and Private Lend the Money for Financial Independence (Retirement)

Some investors who have gained financial independence continue to keep some properties in order to hedge against inflation and continue to provide growth of their asset base over time. Private […]

Continue reading