How to Lose Big Money in Real Estate?

There is really only two ways that you lose money in real estate the first is being greedy and the second is not doing your due diligence. That usually accounts for 97% of the errors that happened.

I constantly hear and read about people giving advice around what to purchase and what they should be selling, but most of them who are giving this advice have little experience.

What is the track record of the person recommending the property and what are there vested interests?

Let’s use the example of a person who recommends a pre-construction condo purchase. The Real Estate Agent may have a few of these purchased but are they still tied to job (Being an Agent) because they are cash flow negative monthly and are betting on appreciation. This is a Net Worth play. It may work well, but it would cause you to put a much larger downpayment or pay out of pocket every month to hold on to the condo once it closes.

Another example is a Real Estate Agent who may have 3 or 4 duplexes, student rentals or regular rentals that cash flow positive every month. It allows them to work less often , travel for weeks at a time, and work at their job because the enjoy it. These properties have also appreciated in a similar way to the condos but the person does not need to come out of pocket to own the asset.

In both examples we have a real estate agent who has a vested interest in you purchasing the property, but they have different track records depending on your needs and wants. Digging a little deeper and asking your real estate agent questions about their personal experiences can effect what you end up purchasing. I see it happen again and again. So be careful!

You also need to look at yourself. You should figure out why you are buying the property and also ask who is selling it or advising you to buy the property.

What kind of system does the person advising you have in place? Who is part of their team that makes owning the property easy? How do they calculate cash flow? What real estate strategies do they employ?

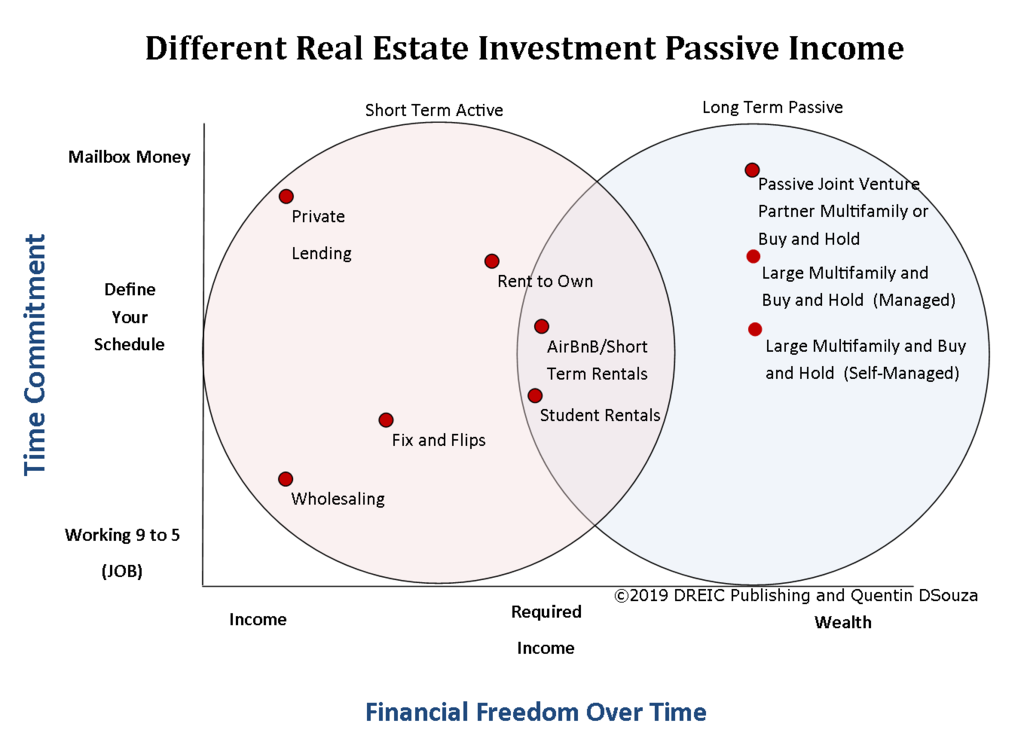

You’ll notice in the chart above where I talk about passive real estate investing. When I speak about real estate ownership there are one of the three reasons that people purchase real estate either for personal use, in order to create income, and/or finally to create wealth. I beleive, that there can be a combination of income and wealth that creates the best effect.

I’m preferential to purchasing land rather than air when it comes to wealth generation from investment real estate. Meaning I would rather own a property either multifamily building, detached house, semi-detached, townhouse rather than apartment condominium. Land appreciates, and buildings depreciate. There are only so many negative cash flow properties that you can buy before you get stuck. But if you buy a property with good cash flow, there is an unlimited amount of properties that you can purchase.

Please look at the actual real estate investment experience of the people who are telling you what to buy, and not simply selling you on what to buy.

I have had many really estate investors come to my after a huge loss where a real estate agent told them that they could flip a property and make lots of money, only to fail. They got greedy. Get rich quick prevailed. After the loss, when asked how many proeprties the real estate agent had flipped it was one ten years ago or none at all.

I have successfully invested in real estate for 15+ years and have been able to work on my real estate business full-time since 2014. The income from my properties did this, not anything else I do.

The way that I teach people to invest in is to grow a portfolio of cash flowing properties that help you to accumulate income and wealth. I’m not trying to be another expert in the real estate investment space. I’d like you to get focused on creating real long-term wealth, like I have been able to do.

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

Should You Continue to Invest in Ontario Real Estate?

Reader Mail: Should I Sell My Condo in Toronto or Keep It?

Unpacking Ray Dalio’s It Starts With Inflation – Key Insights

The Human Element of Money – Key Takeaways Morgan Housel’s The Art and Science of Spending Money

Active vs Passive Investor