- You are here:

- Home »

- Blog »

- Canadian Economics »

- Do Interest Rates Go Down Faster Than They Go Up?

Do Interest Rates Go Down Faster Than They Go Up?

One of the trends that I have heard from mortgage brokers is that interest rates usually go down faster than they go up. As a real estate investor, I’m interested in figuring out what this might look like if we are indeed in an interest rate decrease cycle. Also, how many instances were there where the Bank of Canada had to raise rates again after experiencing three decreases over three months? We have mortgage renewals coming up over the next few years and larger commercial projects that I would like to bring to CMHC for refinancing. So I started to dig.

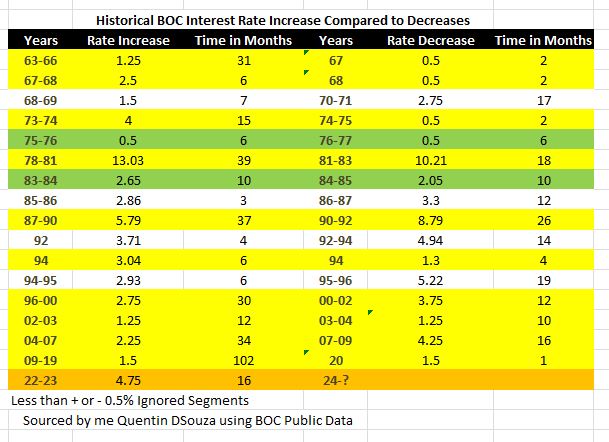

I identified 16 rate increase and decrease cycles in the data. Of these cycles, 10 out of the 16, or 62.5% of the time, the rate decrease cycle occurred less than the increase cycle time. Two times, the cycles were the same amount of time, or 12.5%. There were four times when the rate decrease cycle was much longer than the increase cycle about 25% of the time.

When I examined the years when the period of rate decrease was the same as the rate increase, it was post-recessionary periods. The recessions had ended in March 1975 and October 1982. We are currently not in a post-recessionary period, so there is a lower likelihood of it being the same.

When you lower interest rates, you pull demand from the future to today. Lowering interest rates to 0.25%, as was done from March 2020 to March 2022, pulled forward many purchases that would not have happened if the interest rate had been so low.

So, how long will it take, and how swift will the cuts be? There is more to consider than just the increase and decrease periods in isolation; you also need to look at unemployment, population growth, CPI, and GDP. However, I thought it would be worth examining how this rate-cutting cycle has looked historically.

In the table above, I pulled the Bank of Canada interest rate date from www.bankofcanada.ca and collated it according to the years when the rate increase or decrease happened. Then, I looked at the number of months and the amount of increase or decrease.

How many times were there three decreases in 3 months, and then the Bank of Canada had to increase rates again? I found that this occurred twice.

In 1985, rates increased for two months and then decreased again for another six months, which was the first time. During this period, the Canadian dollar experienced significant volatility and depreciation. The Canadian government, led by then-Finance Minister Michael Wilson, faced economic challenges, including a high national debt and inflation. The government implemented policies aimed at stabilizing the currency and controlling inflation.

This happened again in 1994, when rates decreased for two months, then increased for five months, followed by another rate cut cycle. In 1994, Canada, the United States, and Mexico signed NAFTA to eliminate trade barriers and increase economic cooperation among the three countries.

When I counted the number of months the increase happened, I looked at the first time the rate increased and when it stopped increasing. For example, from 2022 to 2023, the interest rate went up 4.75%, which was the largest increase in the last 30 years but only the third largest increase in the last 60 years.

Of these three largest hikes, the 2022 to 2023 one was the quickest, about 60% faster than the other two. The interest rate moved from 0.5% to 5%, which is a 900% increase at the time.

However, I think it’s best if we remove the interest rate data from March 2020, when interest rates dropped by 1% in a month due to the COVID-19 epidemic. So, if we say that interest rates changed from 1.75% to 5%, that is a 285% increase in the interest rate.

The largest rate increase cycle, which took 39 months, was from 1978 to 1981. The interest rate increased by 13.03% (7.45% up to 20.78%), a 268% increase at the time. Interest rates started decreasing in September 1981. There was also a recession that started in June 1981 and went to October 1982. Rates decreased by 10.21% from 1981 to 1983, a 78% reduction of the increase.

The second largest rate increase cycle was from 1987 to 1990, which took 37 months. The interest rate increased by 5.79% (8.23% up to 13.8%), a 168% increase at the time. Interest rates started decreasing in June 1990. A recession also began in March 1990 and went to May 1992. Rates took longer to reduce than the most extensive rate increase cycle. However, the interest rates dropped by 8.79%, a whopping 151% reduction.

The interest rate stayed the same from July 2023 to May 2024. In June 2024, we are now in a rate-cutting cycle. Two interest rate cuts totaled 0.5%, and further cuts are expected.

Remember that there were also recessions that had “officially” started a few months before the last two of the most extensive rate increase cycles. If this were the same, then at the time of writing, we would have already been in a recession for the last few months.

The decreases occurred 46-70% of the length of time of the increases. If we compare 16 months of the 2022 to 2023 increase cycle, then the decreasing cycle would take 8-12 months.

If we look at the length of all the periods, where decreases occurred in a shorter time than increases, the median number would be eight months.

Many economists have stated that to get into a position of a healthier housing market, we should see interest rates that are 1.50-2.00% and interest rates decrease by 2.5-3%. This decrease would be a modest 40% in the interest rate from its May 2024 high.

If we do enter or are in a recession, is a 40% decrease enough? Will we need to make further cuts or risk a more prolonged “great recession”? We can’t lower rates above 105% unless we are willing to go negative.

More questions than answers 🙂

Here are the dates for BOC rate Announcements in 2024:

•September 4

•October 23

•December 11

The BOC 2025 Announcement Dates are the following:

•January 29

•March 12

•April 16

•June 4

•July 10

•September 17

•October 29

•December 10

Sources:

List of recessions in Canada. (2024, June 10). In Wikipedia. https://en.wikipedia.org/wiki/List_of_recessions_in_Canada

Policy interest rate (2024, August 2024) https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

The Elimination of Private Rental Housing in Ontario: Financing (Part 1)

After positive first quarter report, Canada Mortgage and Housing Corporation now forecasting housing prices will stabilize

Canada’s inflation rate was up in January

Canada’s population grows to nearly 33.5 million

Fewer Canadians expect to retire on time