- You are here:

- Home »

- Blog »

- Real Estate Business »

- Active vs Passive Investor

Active vs Passive Investor

I know that there’s been a lot of discussion over the 18 years that I have been investing in real estate around how people describe real estate investing. Oftentimes we hear the word passive income and mistakenly assume that it does not require any time at all, particularly when you’re talking about renting out a single family home, but that really isn’t the case. There is a lot of time and effort in selecting a market, building a team, and managing the asset and/or the property manager, that seems to get left out of that discussion.=

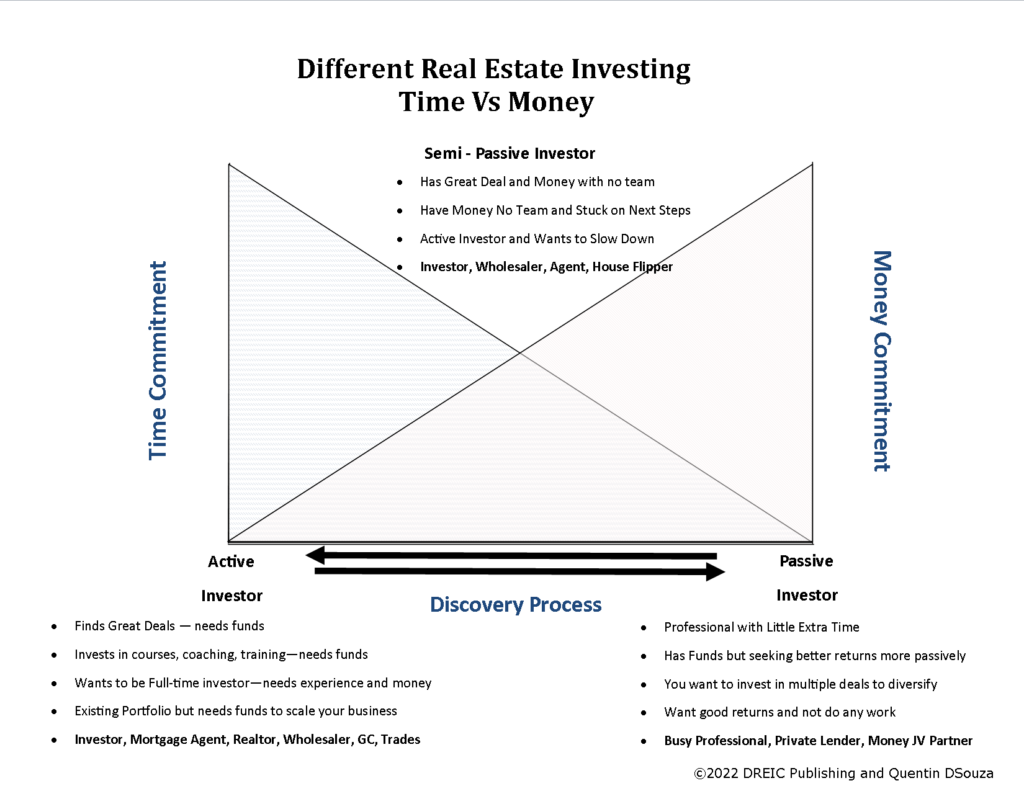

This graphic illustrates the correlation between money and time when it comes to the connection between an active and a passive real estate investor. It also explains what I think a semi passive real estate investor is. Depending on where you are in the spectrum you can be an active investor in some of your investments, a passive and a semi passive investor in other investments. You do not need to always be an active or a passive investor.

At different times in your life you will be either more likely to be an active investor than a passive investor. It just depends on where you are in your phase of real estate investing.

An example of an active real estate investor would be somebody who would be picking up great deals but not necessarily have all the funds ready to go in order to close on those deals, but want to scale their real estate portfolio. This could be an investor looking for joint venture partners, wholesalers, or perhaps a real estate agent looking to transact on a property. These people are all using time and often some money to generate good opportunities.

Another example of an active investor would be somebody who has spent a lot of time educating themselves, maybe through courses, networking events or coaching. They may not necessarily have all the funds in line in order to get all the deals done that they want to get done, but they are ready to apply what they have learned. If you are putting up all the time and all the money you would still be considered an active investor.

Other active investors would be people who want to make full time investing what they do every day. They are driven to succeed but have different paths for success. For example you could have a real estate agent, wholesaler, house flipper or a mortgage agent or a property manager or a trade like an electrician or general contractor. All of those people I would consider active in their role in the real estate industry. They are active in trading more time in order to generate day to day money in what they are doing.

A passive real estate investor I would consider somebody who is putting up the funds in order to invest in a project benefiting from the expertise of the active investor but are getting better than average returns because of the asset class where they are placing their funds. A passive investor could be passive in a storage facility or care home or a multifamily unit apartment building.

Within passive real estate investing there are a range of activities from least returns to highest returns – REIT investing, private lending, private real estate funds, GP/LP and Joint ventures. There is always more risk with higher returns, but it can be mitigated with having done extensive due diligence on the active investors in all of these types of real estate investing strategies.

Some active real estate investors will take their funds and apply them to projects where they are more passive. Other busy professionals focus their time and energy on high income generation in their day to day business or profession, where it makes sense for them to spend the most time, and use their funds to invest to get better than average returns.

Semi-passive investor could be a real estate investor who picks up a condo or a single family home or perhaps does a basement conversion and then uses a property manager in order to manage the month to month commitments of the property. They still need to manage the property manager and carry out various tasks related to real estate investing, so I would consider that semi passive.

A semi-passive investor may not have the network or skills to carry out tasks that are necessary in order to purchase or maintain their investments, and would require active investors to assist them in the ownership process.

Knowing whether you want to be an active, semi-passive, or passive investor will help you to decide on the strategies that you use to invest in real estate. Take some time to think about this. Where do you fit on the spectrum? What type of investments do you want to do? How do they fit into your goals?

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.