- You are here:

- Home »

- Blog »

- Building Wealth »

- Why Paying Off Your Mortgage Might Be Hurting Your Wealth – A Wake-Up Call for Ontario Real Estate Investors

Why Paying Off Your Mortgage Might Be Hurting Your Wealth – A Wake-Up Call for Ontario Real Estate Investors

I shared the article “Why Paying Off Your Principal Residence Still Makes Sense for Ontario Real Estate Investors.” I wanted to write on the other side of not using the equity in your principal residence.

I met up with some friends this week and had a fascinating discussion about the math of dead equity in your principal residence.

When it comes to real estate investing in Ontario, we often hear the same mantra: “Pay off your mortgage as fast as possible.” It’s comforting, it feels safe, and it’s deeply ingrained in our financial culture.

But what if that advice is outdated—and actually costing you hundreds of thousands of dollars?

Let’s move away from the psychology of having a paid-off house as a real estate investor and have a look at the math.

House Equity: Safe Haven or Stagnant Asset?

Your home equity earns 0% return. Whether your house is paid off or mortgaged, its market value stays the same.

Your equity loses to inflation:

When you pay down your mortgage, you’re converting liquid cash into equity—essentially, money locked inside your home. It feels like you’re building wealth, but in reality, that money just sits there, vulnerable to one of the most silent and persistent threats: inflation.

When you pay down your mortgage, you convert liquid cash into equity—essentially, money locked inside your home. It feels like you’re building wealth, but in reality, that money just sits there, vulnerable to one of the most silent and persistent threats: inflation.

Inflation erodes the purchasing power of money over time. In Canada, the average annual inflation rate is around 2%, but in recent years, it has spiked even higher.

So if you’ve built $500,000 of equity in your property, and you don’t touch it for 10 years, that money is no longer “worth” $500,000 in today’s dollars. In fact:

- At 2% inflation, $500,000 today is only worth about $410,000 in 10 years.

- At 4% inflation (which we’ve seen recently), it’s worth just $335,000.

You miss out on investing that capital elsewhere:

Every dollar you use to pay down your mortgage early is a dollar that can’t be invested elsewhere. This is known as opportunity cost—what you forfeit by choosing one option over another.

Instead of locking your cash into your home, you could:

- Buy another rental property

- Invest in index funds or dividend-paying stocks

- Start a small business or invest in private lending

- Keep cash in a high-interest savings or offset account

- Imagine you take $100,000 and pay off part of your mortgage.

- Alternatively, you invest that $100,000 in a conservative index fund at 6% annual return in your registered accounts (TFSA or RRSP).

In 30 years:

- Paid-off equity? Still $100,000.

- Invested capital? Grows to $602,000+.

That’s over $502,000 in missed opportunity, all because you chose psychology over growth.

Let’s Think About This Differently

If you own a $900,000 property and hold $900,000 in liquid assets, your house is “paid off”—but you still have control over your cash.

Is There A Cost of Paying Off Your Mortgage In A Shorter Period of Time

- 15-year left on your mortgage = less flexibility

- Extra payments = lower liquidity

- Lower rates don’t always equal lower costs (think capital expenses on your home)

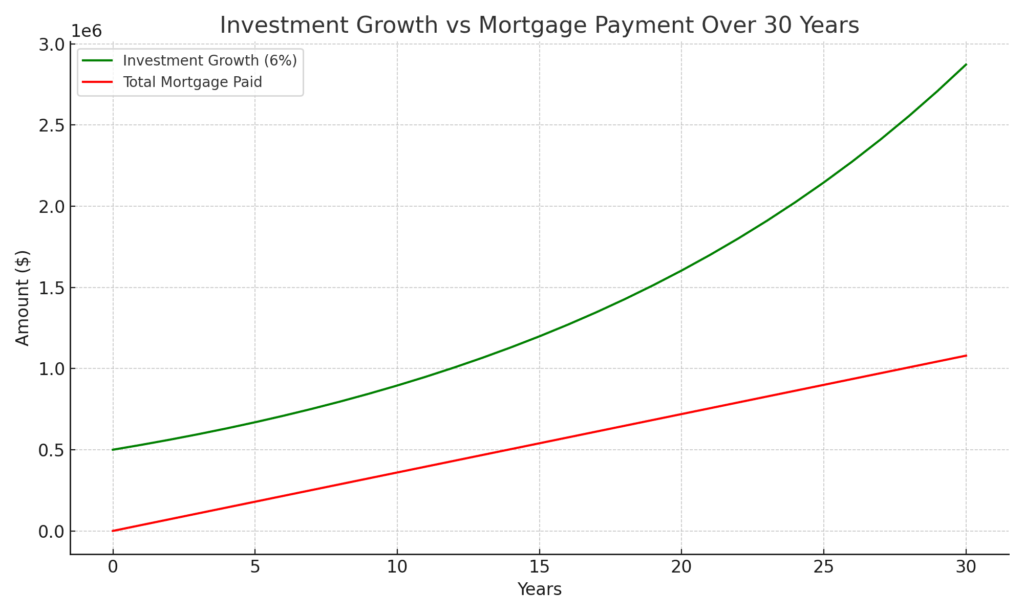

Instead, leverage a longer mortgage term and invest the difference. Here’s what that looks like over 30 years:

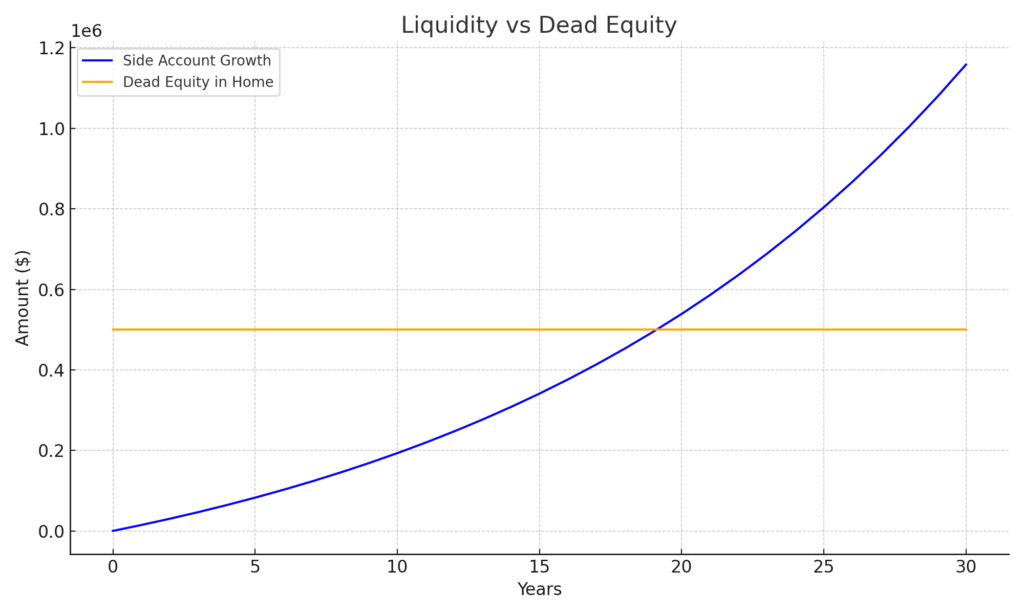

Liquidity vs Dead Equity

Emergency? Job loss? With no access to your equity, you’re stuck. However, a side investment account gives you flexibility and a fallback.

What About HELOCs? A Smart Liquidity Backup

Ontario investors can unlock the power of home equity without fully paying off or refinancing their mortgage using a Home Equity Line of Credit (HELOC). A HELOC allows you to access the equity in your property on demand, acting like a revolving line of credit secured by your home. It’s not just a safety net—it’s a strategic liquidity tool. Instead of parking your cash in your walls, you keep it growing elsewhere while knowing you can access funds if and when needed. A HELOC gives you control and flexibility without compromising your investment growth, whether for emergency expenses, renovations, or the down payment on your next rental property.

A Final Thought: Math Over Emotion

The math is straightforward. Real estate success in Ontario isn’t just about location—it’s about strategy.

“Do you want to feel rich, or actually be rich?”

Ready to Rethink Your Strategy?

Talk to your financial advisors who understand leverage, liquidity, and long-term wealth building. Ontario real estate investing isn’t just about owning assets—it’s about using them wisely.

About the Author Quentin DSouza

Quentin D’Souza is the Chief Education Officer of the Durham Real Estate Investor Club. Author of The Action Taker's Real Estate Investing Planner, The Property Management Toolbox: A How-To Guide for Ontario Real Estate Investors and Landlords, The Filling Vacancies Toolbox: A Step-By-Step Guide for Ontario Real Estate Investors and Landlords for Renting Out Residential Real Estate, and The Ultimate Wealth Strategy: Your Complete Guide to Buying, Fixing, Refinancing, and Renting Real Estate.

Related Posts

The Dunning-Kruger Effect in Real Estate

Unlock Your Portfolio’s Potential: Why Future Value is Your Crystal Ball

Stress Testing Your Real Estate Portfolio This Summer

Staying Open-Minded: A Key to Success for Ontario Real Estate Investors

Who Should Not Be Buying a Small Apartment Building in Ontario?